Economic Pulse

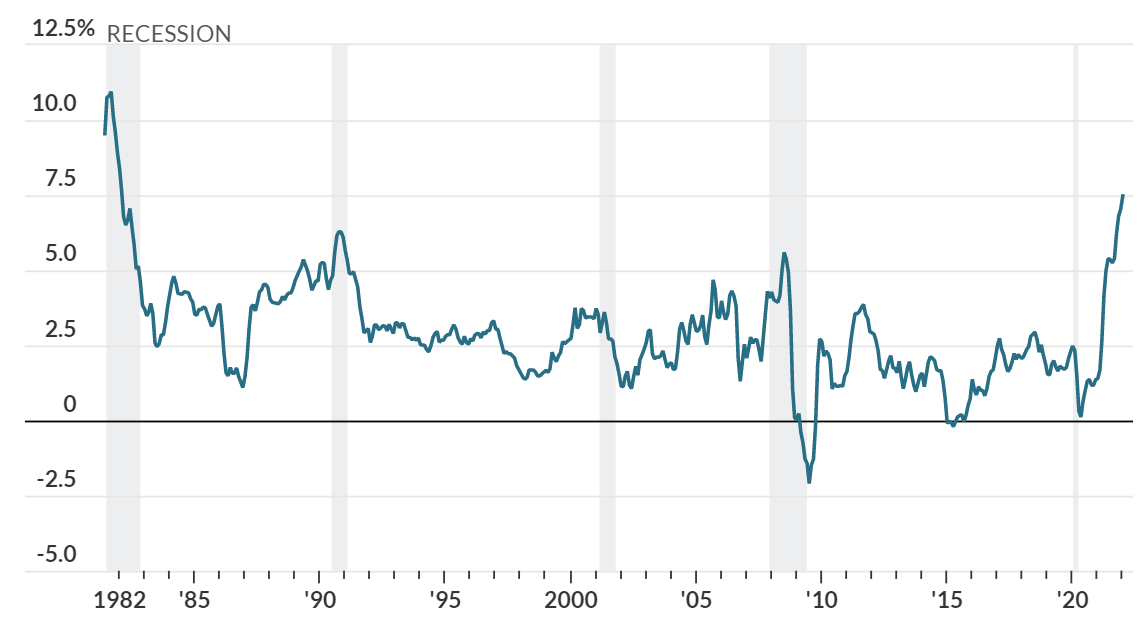

Housing starts drop to 13-month low in May.

U.S. homebuilding fell to a 13-month low in May and permits tumbled, suggesting the housing market was cooling as surging mortgage rates reduce affordability for first-time homebuyers.

Housing starts fell 14.4% to a seasonally-adjusted annual rate of 1.54 million units, the lowest since April 2021. Single-family housing starts, which account for the biggest share of homebuilding, tumbled 9.2% to a rate of 1.05 million units in May.

Permits for future home building declined 7% to a rate of 1.69 million units.

Source: GlobalData

Consumer sentiment slumps to record low.

U.S. consumer sentiment plunged in early June to the lowest on record as soaring inflation continued to batter household finances. The University of Michigan’s preliminary June sentiment index fell to 50.2, from 58.4 in May. The figure was weaker than all estimates in a Bloomberg survey of economists, which had a median forecast of 58.1.

All components of the sentiment index fell this month, driven by inflation fears, with the steepest decline in the year-ahead outlook in business conditions followed by consumers' assessment of their personal financial situation.

Source: GlobalData

U.S. household wealth drops for first time in two years.

U.S. household wealth declined for the first time in two years in the first quarter of 2022 as a drop in the stock market overwhelmed continued gains in home values. As a result, household net worth edged down to $149.3 trillion from a record $149.8 trillion at the end of last year. The decline was driven by a $3 trillion fall in the value of corporate equities, a plunge that has worsened in the current quarter, while real estate values climbed another $1.7 trillion.

It was the first decline in household wealth since the first quarter of 2020, when the onset of the coronavirus pandemic shook financial markets and caused a short but deep recession.

Source: GlobalData

ABOUT ATRIX REAL ESTATE

OUR LOCATION

©2021 Atrix Real Estate. All rights reserved. Corporate DRE #02010384. Privacy Policy